From Cost Centre to Profit Centre: Transforming Retail E-Commerce

By Vladimir Marienko

17 February 2026

Retail leaders rarely question the role of e-commerce any more. In Europe, online shopping is already mainstream: 77% of internet users made at least one online purchase in 2024. Harvard Business Review’s study of 46,000 shoppers found that customers using both online and offline channels demonstrate higher retention and lifetime value than single-channel shoppers.

Yet many companies still treat it as a supporting function rather than a financial driver. In board meetings, online sales often appear as a growing expense line, paired with rising marketing spend, platform fees, and operational overheads. That gap between effort and return is the core problem this article addresses through a real retail ecommerce transformation story.

For Intersport, the digital channel generated only 1–3% of total revenue and processed roughly 50 orders per month. The online store existed, but it did not materially contribute to growth. Leadership faced a clear question: how to turn ecommerce into a profit centre that justifies continued investment.

This article shows how the retail ecommerce transformation happened in practice, working with FlexMade. It focuses on concrete business moves, measurable outcomes, and decisions that C-level teams can apply to turn an underperforming online channel into an ecommerce profit centre with predictable returns.

1. What Profit Centre E-commerce Actually Means

An e-commerce profit centre is an online business unit that produces measurable financial return after accounting for traffic acquisition, technology, fulfilment, and operations. Revenue growth sits alongside margin, cost structure, and predictability as core indicators of performance. For C-level leaders, this model turns e-commerce into a managed business line with clear accountability instead of an open-ended expense tied to experimentation.

This distinction explains why profit-centre thinking has gained attention at the executive level. Their focus is also driven by the broader market trajectory, as e-commerce is forecast to continue taking a larger share of total retail through 2026.

Once online sales are evaluated through contribution margin and operating leverage, decisions about UX, technology, and sourcing become financial choices rather than tactical discussions.

2. Why Most Retail E-commerce Becomes a Cost Centre

Structural ownership gaps

Many retail organisations run e-commerce across marketing, IT, operations, and external vendors simultaneously. Fragmented ownership makes it harder to assign clear financial responsibility, and no single team owns the channel’s profit and loss. This gap becomes more expensive as digital commerce continues to grow globally, raising the opportunity cost of slow execution and unclear accountability.

Conversion loss baked into daily operations

Low conversion can quietly drain profitability before scale becomes a factor. According to research by the Baymard Institute, the global average cart abandonment rate hovers around 70%, meaning roughly seven out of ten shoppers who add products to a cart do not finish their purchase. This represents a substantial portion of lost e-commerce revenue that never turns into sales, which is why many teams prioritise efforts to reduce cart abandonment.

External dependencies that inflate cost

Retail platforms often rely on paid intermediaries for invoicing, inventory sync, and other integrations. These services add transactional fees that grow as volume increases, making financial visibility harder and inflating e-commerce operating costs (OPEX) without driving proportional revenue.

Technology decisions without e-commerce profit centre focus

Platform choices that prioritise quick launch over clean data flows and stable performance add a long-term maintenance burden. Data compiled by Google shows that a one-second delay in mobile page load can reduce conversions by as much as 20%. Slow experiences not only hurt conversion but increase support and engineering workload.

Multiple analyses have shown that load times and user engagement are tightly linked, and improvements in performance often correlate with measurable increases in user actions that affect revenue.

The next section explains how Intersport addressed these specific pressures in partnership with FlexMade, with measurable changes that rebalanced cost and revenue in e-commerce.

3. The Starting Point: Intersport Prior to the Turnaround

Prior to the retail e-commerce transformation, Intersport viewed its online channel as a necessary presence rather than a commercial engine. Physical stores generated almost all revenue, while e-commerce played a supporting role with limited expectations attached to it. This mindset affected investment decisions and operational structure.

Business baseline

Digital sales accounted for roughly 1–3% of total revenue. Monthly online orders hovered around 50, a volume too low to create meaningful leverage or justify deeper optimisation work. Marketing activity brought traffic to the site, yet that traffic rarely converted into completed purchases at scale.

Operational reality

Several business-critical processes sat outside the core platform. Invoicing, refunds, and stock synchronisation relied on third-party proxies connected to the ERP system. These intermediaries introduced latency and recurring fees, while making it harder to trace issues back to a single owner. Oversells and delayed stock updates appeared regularly, adding manual work for operations teams.

Cost profile

E-commerce operating costs increased steadily without a matching rise in revenue. Infrastructure spending, integration fees, and support efforts all grew, but none translated into sustained order growth. Financial forecasting remained difficult because variable costs scaled with usage, while performance bottlenecks limited upside.

At this stage, leadership faced a clear constraint. Continuing on the same path meant higher spending with limited return. Any improvement had to work within a fixed budget and show tangible business impact in months instead of years.

How Leadership Framed the Decisions

Before any implementation work began, leadership aligned on how decisions would be evaluated for the retail e-commerce transformation. The guiding principle was that every change had to improve financial outcomes within the existing budget. That rule eliminated a wide range of options early and helped narrow attention to actions with direct business impact.

The first two goals were to control costs and reduce cart abandonment to increase e-commerce conversion rate. Traffic already reached the site, yet a large share of potential orders disappeared during checkout. Increasing acquisition spend under those conditions would have magnified inefficiency. Improving conversion promised faster revenue impact without raising marketing costs, which made it the most defensible starting point at executive level.

Budget constraints reinforced this focus. With no room for additional infrastructure spend or platform replacement, leadership prioritised changes that reduced friction and recurring fees. Paid intermediaries and opaque integrations stood out as cost drivers that offered limited strategic value. Bringing those flows closer to the core business promised savings and better visibility at the same time.

Expansion initiatives were deliberately sequenced. New markets, feature growth, and broader experimentation waited until the online channel demonstrated stable economics. Early success was defined through concrete signals such as order volume, e-commerce operating costs, and operational reliability rather than softer engagement metrics.

This framing created alignment between business and delivery teams. Working with FlexMade, Intersport moved forward with a shared view of what mattered.

4. Growth in Numbers

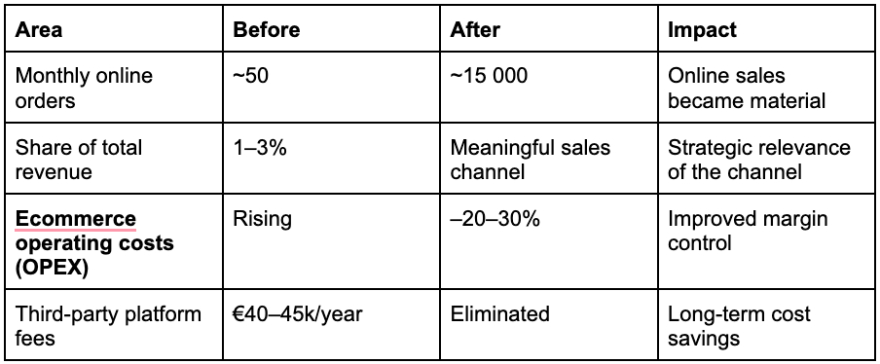

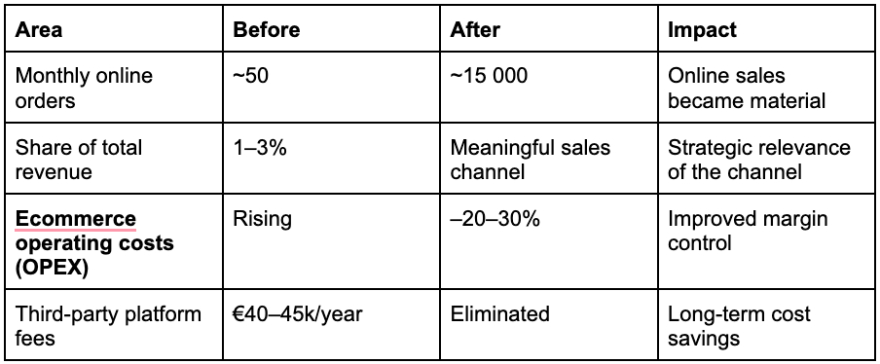

The effect of these changes became visible quickly once performance was tracked against financial metrics expected from an ecommerce profit center. Order volume, cost structure, and operational stability all moved in the same direction, creating a compounding positive effect. These figures reflect operational data from the Intersport program and illustrate how revenue growth and cost reduction reinforced each other.

5. What's Changed: Transforming E-commerce into a Revenue Driver

Fixing conversion where revenue leaked

Checkout and product flows were our first focus because they directly influenced order volume. Google reports that 53% of mobile users leave sites that take longer than three seconds to load. Simplified navigation, clearer pricing, and faster page response reduced friction during purchase. These improvements helped increase ecommerce conversion rate without raising traffic spend. As efforts to reduce cart abandonment took effect, existing demand began translating into completed orders. This created an immediate revenue increase.

Bringing core processes in-house

Several high-impact workflows were moved out of third-party services and into internal systems. Invoicing, refunds, and stock handling became part of the core platform logic instead of external black boxes. This change lowered recurring fees, reduced latency, and improved visibility across operations. Annual savings reached €40–45k while support effort dropped due to fewer failure points.

Using a proven technical baseline

Rather than experimenting with untested setups, the team relied on an architecture already validated in large-scale retail. FlexMade reused patterns that had worked in previous commerce projects and adapted them to Intersport’s processes. This led to shorter delivery timelines and decreased risks, while the team could focus on refinement instead of rebuilding fundamentals.

Together, these decisions transformed the online store into an ecommerce profit center with growing order volume and lower ecommerce operating costs (OPEX).

Growth in Numbers

The effect of these changes became visible quickly once performance was tracked against financial metrics expected from an ecommerce profit center. Order volume, cost structure, and operational stability all moved in the same direction, creating a compounding positive effect. These figures reflect operational data from the Intersport program and illustrate how revenue growth and cost reduction reinforced each other.

6. A Reusable Handbook for Retail Leaders

The outcome at Intersport was not driven by a single decision or a one-off optimisation, but by a structured retail e-commerce transformation with clear priorities. It followed a repeatable set of actions that retail executives can apply when an online channel shows weak returns despite steady investment.

In this section, we are offering reusable lessons to use when aiming to reduce basket abandonment, increase e-commerce conversion rate, and lower e-commerce operating costs without increasing risk.

Assign clear financial ownership

Treat e-commerce as a business unit with defined revenue, cost, and margin targets. One accountable owner changes how priorities are set and how trade-offs are evaluated.

Tie UX work to revenue metrics

Conversion, checkout completion, and order success rate should sit next to traffic metrics in executive dashboards. This makes it easier to justify UX investment with financial impact.

Reduce basket abandonment before buying more traffic

High abandonment amplifies acquisition costs without increasing sales. Fixing checkout optimisation and performance issues often delivers faster payback than expanding marketing budgets.

Internalise processes that define margin

Invoicing, refunds, and inventory logic directly affect cost and customer trust. Bringing these workflows in-house improves transparency and lowers recurring fees.

Reuse architectures that already proved scale

Starting with a validated technical foundation shortens delivery cycles and limits risk. Teams spend less time correcting structural issues and more time refining performance.

Track e-commerce operating costs weekly

Regular visibility into e-commerce operating costs (OPEX) makes cost growth easier to spot early. This supports better planning as order volume increases.

Plan for growth beyond the first market

Even a single-country store benefits from multi-market thinking. Standardised data models and workflows reduce future expansion effort and cost.

These steps form the foundation of a retail e-commerce transformation that supports long-term profitability instead of short-term gains. The next section consolidates the most relevant takeaways for executives evaluating their own online channels.

7. Operational Changes: In-House vs Third-Party Provision

The most significant operational difference arose from reclaiming control over core workflows. Previously, invoicing, refunds and stock synchronisation depended on external intermediaries connected to the ERP system. Each additional layer increased cost, response time and coordination effort.

Following internalisation, these processes resided within the order management flow. Data moved directly between systems, ownership became clearer, and incidents were easier to trace and resolve. Financially, recurring fees were eliminated. Operationally, teams spent less time managing exceptions and more time improving throughput.

This change also improved planning accuracy. Costs no longer scaled unpredictably with transaction volume, and leadership gained clearer visibility into how operational decisions affected e-commerce ROI.

8. Key Considerations for Senior Management

- Retail e-commerce transformation becomes profitable once it is managed as a business line with clear ownership, financial targets, and accountability that mirrors offline channels.

- Conversion and checkout optimisation have a direct impact on revenue efficiency and should be treated as financial levers rather than interface details.

- Bringing margin-defining processes inside the core platform lowers recurring fees, improves transparency, and simplifies operational control.

- Order growth and lower e-commerce operating costs reinforce each other when technical decisions support scale without adding overhead.

- A validated foundation makes it easier to grow online sales into a meaningful share of total revenue without reopening structural decisions.

9. Conclusion: Transforming an Unprofitable Channel into an E-commerce Profit Centre

The Intersport retail digital transformation case study demonstrates that profitable e-commerce does not necessitate unlimited budgets, aggressive traffic growth, or constant platform changes. The key differentiator was disciplined decision-making regarding the allocation of funds, ownership, and effort. Once leadership treated the online channel as an e-commerce profit centre with clearly defined inputs and outputs, decisions became more straightforward and outcomes more predictable.

The retail e-commerce transformation also highlights a frequently overlooked point. E-commerce rarely fails due to a lack of demand. It typically fails because structure, cost control, and execution are not synchronised. When you increase e-commerce conversion rate, bring core processes closer to the business, and technology supports scalability without inflating overheads, online sales begin to function as a genuine business unit.

The FlexMade x Intersport retail e-commerce transformation example proves that even a channel stuck at 1–3% of revenue can become a significant contributor once decisions are guided by economics rather than habit.

10. Figures you can reference.

These figures provide external context for the business outcomes described above and help ground the case in widely observed retail patterns.

Average cart abandonment in retail e-commerce is ~70%.

Source: Baymard Institute, based on large-scale checkout usability studies

https://baymard.com/lists/cart-abandonment-rate

Extra costs, forced account creation, and long checkout flows are the top abandonment drivers.

Source: Baymard Institute, Checkout UX Research

https://baymard.com/checkout-usability

A one-second delay on mobile pages can reduce conversion rates by up to 20%.

Source: Think with Google, mobile performance research

53% of mobile users leave a site that takes longer than three seconds to load.

Source: Think with Google, consumer behaviour studies

https://www.thinkwithgoogle.com/consumer-insights/consumer-trends/mobile-site-load-time-statistics/

77% of European internet users made at least one online purchase in 2024.

Source: Eurostat, E-commerce statistics for individuals

Retailers with integrated online and offline operations achieve higher customer retention and lifetime value.

Source: Harvard Business Review, “A Study of 46,000 Shoppers Shows That Omnichannel Retailing Works”

https://hbr.org/2017/01/a-study-of-46000-shoppers-shows-that-omnichannel-retailing-works

Worldwide e-commerce sales are forecast to rise each year, with a steady increase in market share of total retail; forecasts suggest e-commerce’s share could be over 21% in 2026.

Source: eMarketer global e-commerce projections

https://alloutseo.com/ecommerce-stats/

E-commerce market size studies show the global digital commerce turnaround value continuing double-digit growth, illustrating expanding economic scale and relevance.

Source: UNCTAD

https://unctad.org/system/files/official-document/dtlecde2024d3_en.pdf?utm_source=chatgpt.com

Get in touch

- Telephone Number: +1 (425) 247-0867

- Email Address: [email protected]